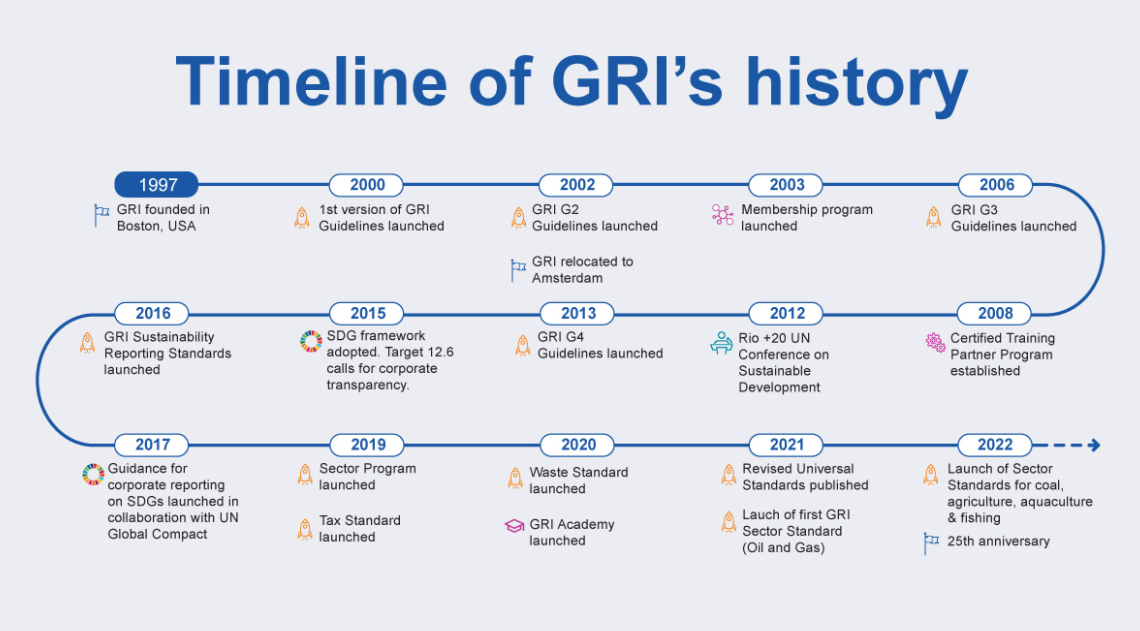

GRI: what it is and how its standards are evolving

GRI (Global Reporting Initiative) is the independent, international organization that helps businesses and other organizations take responsibility for their impacts, by providing them with the global common language to communicate those impacts. It provides the world’s most widely used standards for sustainability reporting – the GRI Standards.