Learn about the EU Omnibus update and its impact on CSRD, CSDDD scope, thresholds, and corporate sustainability obligations.

On 9 December 2025, EU legislators reached a provisional agreement under the first “Omnibus” package to simplify the regulatory burden associated with sustainability reporting and corporate due diligence.

The agreement affects two major pieces of legislation for corporate sustainability: the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD).

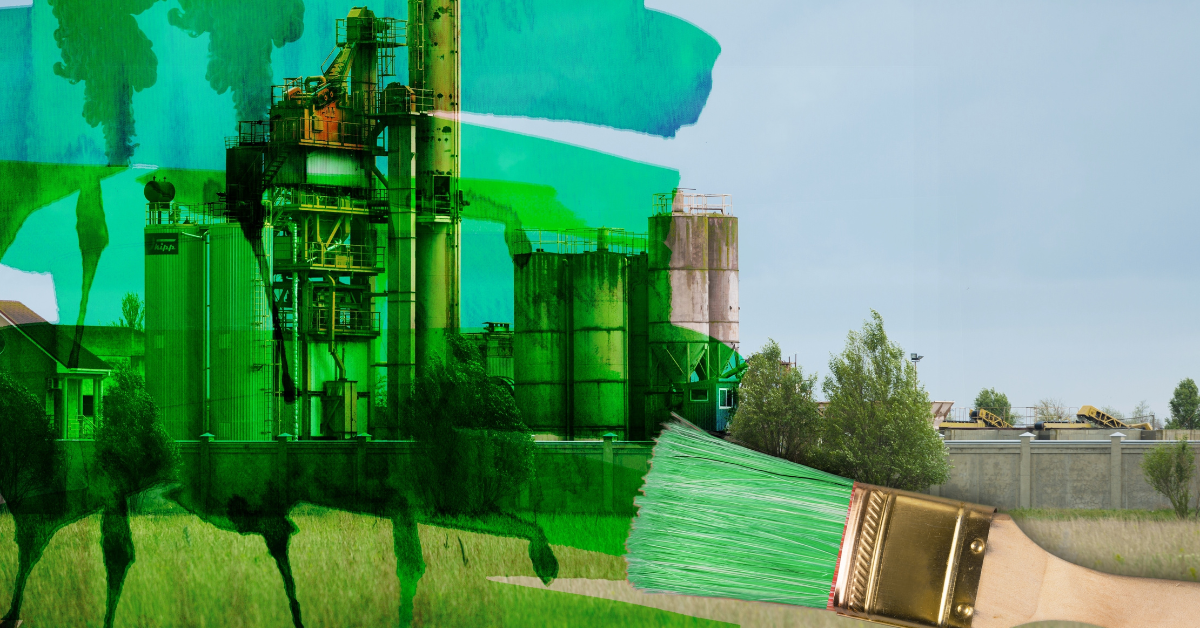

However, critics warn that the changes substantially weaken the original ambitions of EU sustainability and human-rights legislation.

Let’s see the main changes, the motivations behind them, and what remains ahead before final adoption.

Key changes under the agreement

One of the most significant changes concerns the scope of companies required to comply with CSRD reporting.

Under the provisional agreement, only companies that meet both of the following conditions will be subject to mandatory sustainability reporting:

· Employment: more than 1,000 employees;

· Net turnover: more than €450 million.

In practical terms, this raises the thresholds compared to the original state.

The legislators also agreed to exclude listed small and medium-sized enterprises (SMEs) from CSRD’s scope, further reducing the number of firms directly impacted by the directive.

The rationale behind this tightening of scope is explicitly to relieve medium-sized firms from the heavy compliance burden and prevent an overly broad trickle-down effect in supply chains, where smaller suppliers might be required to supply detailed environmental and social data.

This change effectively limits mandatory reporting to relatively large companies, shrinking the set of in-scope firms by a considerable margin.

CSDDD: Due diligence obligations narrowed and delayed

For the CSDDD, which obliges companies to identify and prevent human rights and environmental harms in their operations and supply chains, the provisional agreement introduces even more stringent thresholds.

Under the new deal, the obligations will apply only to companies with more than 5,000 employees and a net turnover exceeding €1.5 billion.

In addition, the agreement drops some of the most ambitious components initially foreseen.

In particular, the previously proposed requirement for companies to adopt a climate transition plan, designed to align business models with the objectives of the Paris Agreement, has been eliminated.

Regarding enforcement, the legislators set the maximum penalty for non-compliance at 3 percent of the company’s worldwide net turnover in order to provide a balance between maintaining some deterrence and limiting exposure for large global corporations.

Finally, the transposition timeline has been postponed. The provisional agreement extends the deadline for member states to transpose CSDDD to 26 July 2028, with companies required to comply by July 2029.

The motivation behind the EU Omnibus regulation: Reducing administrative burden, boosting competitiveness

Supporters of the simplification argue that the original CSRD and CSDDD regimes risked placing unsustainable compliance burdens on European companies, particularly in a global environment where non-EU competitors often operate under less stringent rules.

In this context, the Omnibus package is intended to reduce bureaucratic complexity, lower compliance costs, and restore regulatory predictability.

Under the new layout, many medium-sized enterprises and even some large firms under the new thresholds may be able to focus on business innovation and growth rather than extensive climate- and ESG-reporting mechanisms.

Proponents also argue that companies still notionally interested in sustainability can continue to apply voluntary reporting standards, without the weight of mandatory legal obligations reflecting a broader EU ambition to align green transition goals with economic competitiveness, especially in the face of increasing pressure from global markets, including non-EU jurisdictions.

Criticism and concerns: Is this a retreat from EU sustainability ambitions?

Despite the arguments in favour of simplification, the provisional agreement has drawn significant criticism for undermining the effectiveness of regulatory safeguards for climate, human rights, and environmental protection.

One major concern is that by raising thresholds and narrowing the number of covered companies, the reforms exempt the vast majority of firms in the EU economy from binding obligations.

Even if many mid-size and small firms may still voluntarily report, the mandatory oversight and detailed supply-chain due diligence obligations are now limited to a small fraction of very large corporations.

Moreover, by eliminating mandatory climate transition plans and weakening requirements for downstream value-chain scrutiny, the new rules may reduce corporate incentives to meaningfully decarbonize operations or prevent environmental and human rights violations by subcontractors and suppliers.

Finally, critics argue this undermines the original purpose of the CSDDD, which aimed to create robust corporate accountability throughout supply chains.

Current status and next steps

At present, the agreement is provisional.

The deal reached on 9 December 2025 must still be formally adopted by both the Council and the European Parliament.

Nonethless, according to the publicly available timeline, the vote in the Council is scheduled for 10 December 2025, while the European Parliament will hold a plenary session to vote on the agreement on 16 December 2025.

If approved, the amended directives will be published in the Official Journal of the European Union and then transposed into national laws by member states.

Following transposition, companies meeting the new thresholds will have to comply with the provisions: for CSDDD, compliance will need to be in place by July 2029.

The provisional agreement also includes a “review clause”, meaning that the scope of CSRD and CSDDD could be examined in the future, potentially expanded again if deemed necessary.

Implications for businesses, stakeholders and EU climate ambitions

For many companies in the EU, especially mid-sized firms, the simplification will likely come as a relief.

The removal of rigorous reporting obligations and due diligence requirements reduces compliance costs, administrative burdens and the risk of fines. It may also ease operations in complex supply-chain environments, where previously mandated due diligence could be onerous.

However, for stakeholders interested in strong environmental, social, and governance (ESG) standards, human rights, and climate accountability, the new agreement signals a retreat from the ambitious regulatory framework initially envisioned.

With fewer firms under binding obligations and less stringent requirements for those covered, the capacity of the EU to enforce uniform sustainability standards across supply chains may be weakened.

Moreover, the elimination of mandatory climate transition plans undermines the regulatory impetus for companies to align their business models with the goals of the Paris Agreement.

Although voluntary standards remain possible, without mandatory obligations many companies may deprioritize such commitments, especially in sectors where cost and competitiveness drive decisions.

At the same time, the review clause offers a potential path to re-expansion, meaning the simplification need not be permanent. Should pressure from civil society, investors, or climate-related crises increase, the European institutions may revisit and tighten the rules again.

Finally, the new timeline provides breathing room for companies and member states alike: firms have more time to adjust, and governments can plan phased transposition.

But that delay also means that accountability under CSDDD will remain limited until at least 2029 for many companies.

An evolving regulation

The provisional agreement on the first “Omnibus” package marks a critical turning point in the EU’s sustainability regulatory framework.

In raising thresholds for mandatory reporting and narrowing due diligence obligations, the deal reflects a pragmatic recalibration aimed at prioritizing competitiveness, administrative simplicity, and regulatory predictability.

However, this pragmatism comes at a cost: the scope of legally binding sustainability obligations is significantly narrowed and delayed; key elements such as climate transition plans are removed; and the reach of the law is limited to a relatively small group of very large firms. For an initiative that originally sought to embed sustainability and human rights into the fabric of EU corporate governance, the agreement may represent a substantial step back.

Whether the simplification will ultimately lead to more efficient sustainability practices or to diluted environmental and social accountability depends on what happens next: the formal votes, the subsequent transposition by Member States, and whether the promised “review clause” will be used to reinstate more ambitious standards.

In any case, companies, investors, civil society and policymakers will be watching closely until 2029 to see whether this regulation makes the EU greener and more competitive, or simply less rigorous.

As for the next steps, the provisional agreement must now be approved by the Council and the EU Parliament before being formally adopted by the two institutions.

At present, the Council vote is scheduled for December 10, while the Parliament vote in plenary session is scheduled for December.

On December 16 2025, the EU Parliament voted in plenary session on the provisional agreement reached with the Council on the text of the First Omnibus Simplification Package.